Pentru achizitiile de produse care urmeaza sa fie expediate in afara tarilor din Uniunea Europeana, Flanco ofera clientilor sai serviciul de

Tax Free

.Clientii Flanco, persoane fizice cu varsta peste 18 ani, care doresc sa achizitioneze in regim de Tax Free trebuie sa completeze formularul "Document de restituire a taxei pe valoarea adaugata cumparatorilor straini" in 2 exemplare.

Originalul acestui document, impreuna cu originalul facturii, sunt inmanate clientului, iar cel de-al doilea exemplar va ramane la magazinul Flanco autorizat - modelul documentului este conform legislatiei in vigoare.

• cumparatorul, persoana fizica (cu varsta peste 18 ani) este stabilit in afara UE (adresa sau domiciliul sau permanent nu este in interiorul UE). Adresa sau domiciliul permanent inseamna locul specificat astfel in pasaport sau carte de identitate;

• bunurile achizitionate sunt expediate sau transportate in afara UE inainte de sfarsitul celei de-a 3-a luni care urmeaza lunii in care are loc livrarea;

• valoarea totala a bunurilor achizitionate, inclusiv TVA, depaseste contravaloarea echivalentul in lei a 175 Euro la cursul stabilit anual in prima zi lucratoare din luna octombrie si valabil de la 01 Ianuarie a anului urmator;

• cumparatorul strain (cu varsta peste 18 ani) poate solicita restituirea TVA aferente mai multor facturi, numai daca suma fiecarei facturi depaseste contravaloarea mentionata mai sus;

• exista dovada exportului bunurilor prin existenta facturii care poarta viza biroului vamal iesire din UE; in cazul in care cumparatorul paraseste teritoriul UE pe cale aeriana, cu escala in alt stat membru, pentru bagajele de mana se prezinta la biroul vamal de iesire din acel stat membru, iar pentru bagajele predate la cala, la biroul vamal de iesire din Romania;

• bunurile sunt cumparate de la magazinele din reteaua de vanzare cu amanuntul autorizate sa efectueze vanzari de bunuri, care confera cumparatorilor care nu sunt stabiliti in Comunitatea Europeana dreptul de a solicita restituirea taxei pe valoarea adaugata, potrivit listei de AICI.

• restituirea TVA se va efectua doar în magazinul care a emis documentele și din care produsul a fost achiziționat.

• document de restituire TVA in original semnat si stampilat de Vama prin care se paraseste spatiul intracomunitar;

• copie a facturii vizate de catre biroul vamal;

• prezentarea de catre client a actului de identitate.

Flanco offers its customers the Tax Free service for purchased goods that are shipped outside the European Union countries.

Flanco customers aged at least 18 who wish to purchase goods that are eligible for the Tax Free service must fill in the “VAT Refund Form for Foreign Buyers” in two copies.

The original document and invoice are handed to the customer, while the other copy is kept by the authorized Flanco store – the model document complies with the applicable legislation.

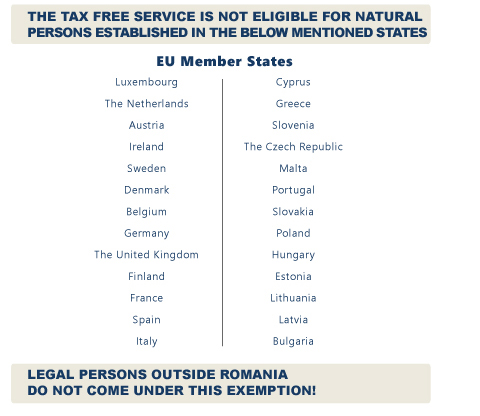

• the buyer, natural person aged at least 18, is established outside the EU (their address or permanent residence are outside the EU). The address or permanent residence refer to the location thus specified on the passport or ID card;

• the purchased goods are shipped or transported outside the EU within three months from the month when the goods are delivered;

• the total value of the purchased goods, including VAT, exceeds the lei equivalent of 175 euros, at the exchange rate annually established during the first working day of October and valid from January 1st of the following year;

• the foreign buyer (aged at least 18) may ask for the VAT refund for several invoices, only if the amount on each invoice exceeds the value mentioned above;

• the export of goods is confirmed by the existence of the invoice bearing the customs stamp on leaving EU territory; if the buyer leaves the EU territory on a transit flight via another EU Member State, the hand baggage must be presented to the customs office of exit from that state, and the hold baggage must be presented to the customs office of exit from Romania;

• goods are purchased from the retail stores authorized to sell goods, providing the buyers that are not established in the EU the right to ask for the VAT refund, in line with the list available HERE.

• the VAT refund will be made only in the store that issued the documents and from which the product was purchased.

• original VAT refund document signed and stamped by the customs officer when leaving the intra-community space;

• copy of the invoice stamped by the customs office;

• showing of the customer’s ID.